Sector Performance Metrics: 3294003314, 3294717494, 3294918307, 3294998527, 3296578662, 3302949575

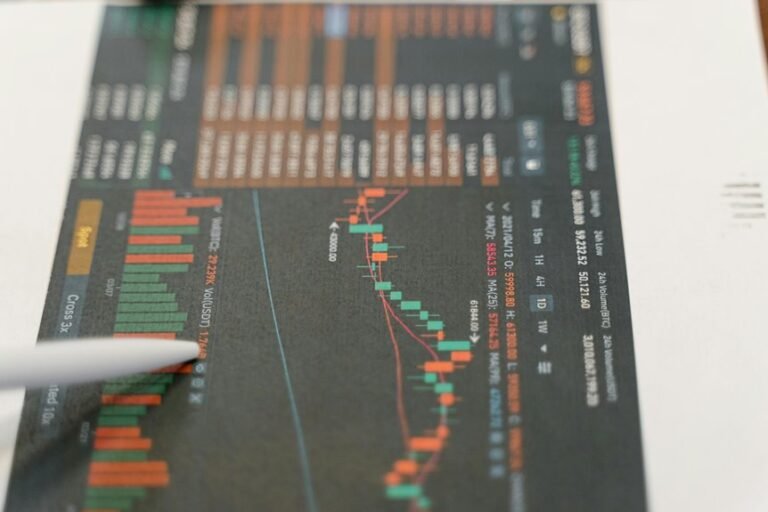

Sector performance metrics serve as vital tools for evaluating the health of various industries. Identifiers such as 3294003314 and 3294717494 offer distinct insights into market dynamics. By scrutinizing these metrics, one can identify trends and anomalies that may impact investment decisions. Understanding the implications of these indicators can inform strategies that align with current market conditions. However, the specific outcomes of these analyses warrant further exploration to fully grasp their significance.

Understanding Sector Performance Metrics

Understanding sector performance metrics is crucial for investors and analysts seeking to evaluate the health and potential of various industries.

By analyzing sector trends and comparing them against established performance benchmarks, stakeholders can glean insights into market dynamics.

This data-driven approach facilitates informed decision-making, empowering investors to identify promising opportunities while mitigating risks inherent in fluctuating economic landscapes.

Analyzing Specific Identifiers

While evaluating sector performance, analysts must focus on specific identifiers that serve as critical indicators of industry health and growth potential.

Identifier analysis enhances understanding of metric significance, allowing stakeholders to discern trends and anomalies within data.

By employing rigorous methodologies, analysts can extract actionable insights, fostering informed decision-making.

Such precision in evaluation underscores the importance of data-driven strategies in maximizing sector growth opportunities.

Implications for Investment Strategies

How do the insights derived from sector performance metrics shape investment strategies?

By analyzing economic indicators and market trends, investors can strategically navigate sector rotation, aligning their portfolios with performance benchmarks.

This data-driven approach mitigates investment risk, enhancing portfolio diversification.

Consequently, understanding sector performance metrics empowers investors to make informed decisions, optimizing their strategies in response to evolving market dynamics.

Conclusion

In conclusion, sector performance metrics serve as a compass for investors navigating the complex market landscape. By meticulously analyzing identifiers such as 3294003314 and 3294717494, stakeholders can illuminate trends and identify potential growth avenues. This data-driven approach not only enhances portfolio diversification but also empowers investors to tread cautiously amidst market fluctuations. Ultimately, these metrics act as a lighthouse, guiding informed decision-making and strategic investment in an ever-evolving financial environment.